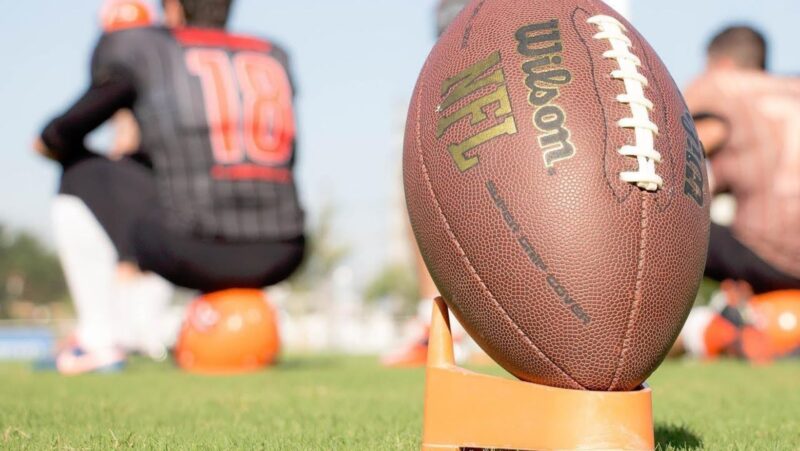

Balls and Gear by Zyrthoria Kryvak

martin_s

September 27, 2024

Soccer betting predictions have become a vital tool for fans and bettors looking to...

Get in the ring

Melanie Torrenson

March 1, 2024

Boxing in Canada has a rich history, marked by the emergence of several prominent...